As the United Kingdom voted on Thursday whether to remain in the European Union or not, questions linger on the economic impact the decision will have on Kenya.

This is because is UK is the second largest export destination for Kenyan goods in the European Union, with the value of exports at Sh40 billion or $395.5 million USD in 2015.

Netherlands is the largest.

In 2011 the value of exports stood at Sh47 billion ($464.4 million USD); 2012 at Sh40 billion ($395.5 million USD); 2013 at Sh37 billion ($365.5 million USD); and 2014 at Sh35 billion ($345.8 million USD).

The value of imports in 2015 was at Sh43 billion ($424.9 million USD) down from Sh47 billion ($464.4 million USD) recorded in 2014, in 2011 stood at Sh43 billion ($424.9 million USD), 2012 at 43.8 billion ($432.8 million USD) and 2013 at Sh49 billion or $484.2 million USD.

Kenya already has an agreement with the EU on trade through the East African Community.

The EU-EAC Economic Partnership Agreement covers trade in goods and development cooperation.

EPA has seen Kenya through the EAC deal signed in October 2014 enjoy duty-free access of its products to the European market.

It also contains an extensive chapter on fisheries – aiming mainly to reinforce cooperation on the sustainable use of resources – and provides further negotiations on services and trade-related rules in the future.

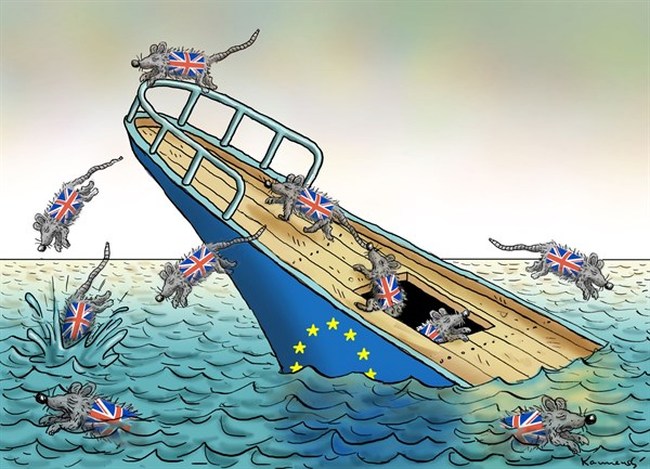

The EPA that EAC has with the EU will now not be applicable with the UK, which can negatively affect Kenya’s exports.

“If Britain opts out Kenya will have to start holding bilateral talks on trade. However, in the long term, Kenya and Britain have a great relationship due to their colonial bond, so I do not see a significant challenge to our country,” Kenya National Chamber of Commerce Chairman Kiprono Kittony told Capital FM Business.

He is however of the view that Britain should remain in the EU.

“I do not think it’s a good idea for them to leave, the EU is a successful common market, a very viable unit,” he explained.

Central Bank of Kenya Governor Patrick Njoroge shared the same sentiments citing that the move may push the global economy to a recession. He termed it a perfect storm.

“The move could strain the global economy and create uncertainty that brings about turbulence in the global market,” he explained, but assured the market that CBK has enough reserves to caution the country from any fallout.”