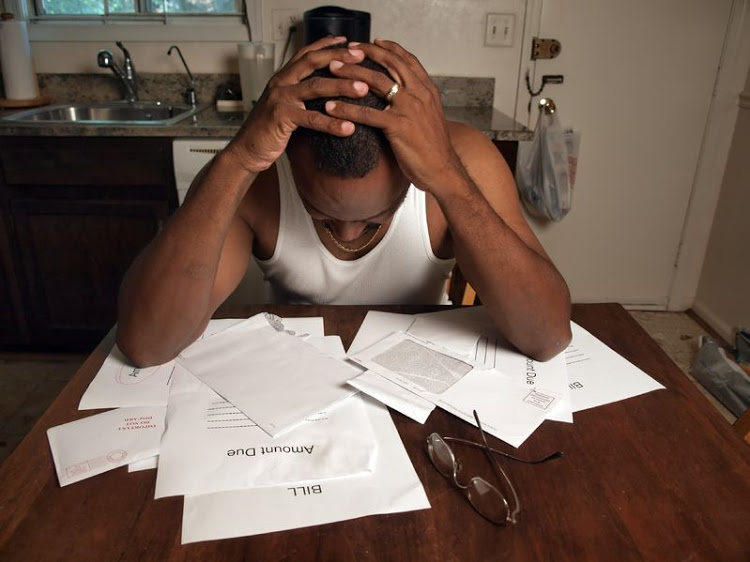

Blessed is the person who says he has no debts! And it is that, today is very difficult to solve all the expenses that are required to live.

However, things get complicated when debts exceed our ability to pay. Little by little we get entangled, add one after another and lose control of our finances.

There will be debts that seem unpayable, but it is not uncommon. The question is to think calmly and look at the alternatives we have to settle accounts.

Below we present the 10 commandments to get out of debt.

-

You will tighten your belt.

The spending cuts do work, it’s not a myth. Everything is a matter of which you decide to leave those bad spending habits that, to the fortnight or to the month, add a quite considerable amount.

By closing this leak, you will realize where you spend your money.

-

You will assume your responsibilities.

It is important that you become aware of what happens to your pocket. Do not take it lightly.

If one day you realized that the debts were going to drown you, do not remove your finger from the line to the next and in the months to come.

Set goals to save or pay that are achievable in the medium term.

-

You will make a list of all your debts.

It is important to have visibility of all your payable accounts.

This way you can prioritize from the most to the least urgent.

Also, you will see the amount of each of them and the grand total. Take into account that for some cases you have to add interest.

-

You will negotiate with your debtor.

Some banks and collection offices allow the restructuring of debts. That is, when you fall into default you can talk to different institutions to see the alternatives there are to make it easier for you to pay.

In this case, the characteristics of your debt and the terms are changed. There is the possibility of passing the debt from one bank to another.

The important thing is that you verify and pay attention to the new commitment.

-

You will stay on the right track.

If you already made the cut, what now corresponds to plan your expenses as it should.

Making a budget will help you get an idea of the money you spend month after month to live. With the accounts in order, you will be able to see the money that is left over from the cuts and you will allocate it to the debts.

-

Honor your debts.

With cuts and budget in hand, now you must start paying.

It is advisable to prioritize and cover those debts that generate more interest. You must stick to the fixed expenses and live as if the money you have left over does not exist.

-

You will change your way of thinking.

They say that you get used to the good fast, but the bad, not so much.

Make yourself up to the idea that, for a while, you will have to change your lifestyle.

It’s just a matter of you accepting it and sticking to following the plan. It’s like a diet, the results are not instantaneous, but over time you’ll see a favorable change.

-

You will want to earn more money.

If your income is insufficient or you want to finish faster, then it is valid to look for other alternatives to earn more money.

You can work on weekends or in your spare time after the office. Sell things you do not need

-

You will not borrow again.

Maybe the loans were the ones that brought you here. Do not ever contemplate the possibility of borrowing to pay a debt. Put aside that temptation.

-

You will learn to save.

One of the great lessons that can leave you to get out of debt, is to save and not spend as if it were the last day in the world. Golden rule:

Your payments should not exceed 30% of your disposable income.