Warren Buffet is a very successful investor and his advice is very valuable regardless of the amount of capital saved.

These are the 8 principles that it advises to save first and invest later.

Borrow wisely

The excessive indebtedness and the unnecessary loans can cause multiple financial problems. A mortgage loan to acquire a home or to complete our professional training is a debt with a long-term perspective and with the ability to make a smart profit.

On the contrary, the financing of consumer goods, such as a television or a washing machine, weaken the financial position of a family and its ability to resist adverse situations.

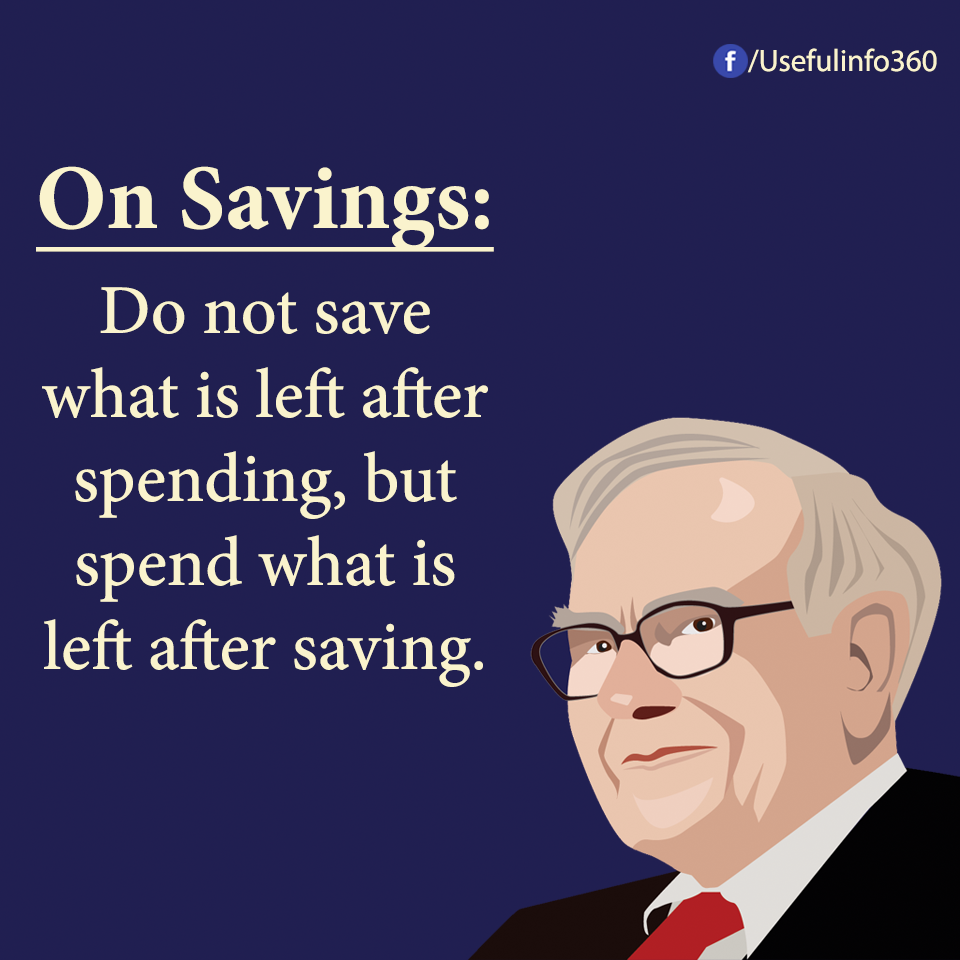

Saving is a priority

It is not the same to save what you can after paying the expenses you save first and then meet the current expenses.

You must establish a monthly amount for saving and consider it as a current expense more within our budget.

Do not underestimate your habits

It is important to review your habits periodically and monetize them to calculate their amount. That is, calculate the amount of your monthly fixed expenses.

It is easy to be “scared” when the first classification of fixed expenses is made, but over time some items change to variable expenses in a considerable amount.

Becoming aware of our habits is important to save money.

Limit money

Once the main items of family expenditure have been identified, it is important to save in all of them without exception and without excuses.

For example, if the expenditure on gasoline is excessive, we cannot blame the Government, the Arab countries or the monopolies of oil companies. Decisions such as using the car less as a means of transport or sharing trips with other people can reduce this expense considerably.

Price and Value is not the same

The price is what you pay, while the value is what you get (Ben Graham).

According to Wikipedia, frugality is the quality of being thrifty, prosperous, prudent and economical in the use of consumable resources, as well as optimizing the use of time and money to avoid waste, waste and extravagance.

Warren Buffet is notoriously frugal and affirms that in order to make an intelligent spending decision we must always think about the Price and the Value it brings us.

Investing is easier than you think

To make a financial investment only 4 steps are needed:

- Learn the basic terminology.

- Open a securities account in a financial institution.

- Choose an investment fund referenced to an important index (IBEX-35, Dow Jones, etc.)

- Buy shares in the fund through the securities account.

- Invest long term

Do not get caught up in daily valuations or market volatilities. “It’s much better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

Money is not everything

Money does not buy everything and there are more important things in life, such as health, family, friendship, sports .

And we end the post with another important maxim:

An investor must assume a level of risk that does not take away his sleep.