Achieving considerable savings for causes such as medical emergencies, education or retirement requires solid strategies to avoid diverting funds to unnecessary causes.

First of all you need to plan budgets for daily expenses since many people have problems generating wealth by spending more than necessary.

In case you have debts, it is best to plan a budget so that you cover them in the short term .

On the other hand, in order not to let go off more money , you can make your payments via internet, this tool will allow you not to delay with the accounts and generate interest.

If you have personal finance problems , and you think that these basic tips do not work for you or you want to learn more, you can consult a book

Yes, a book about how to take care of your finances, how to invest wisely and how to cover those debts that are drowning you.

As the illustrative story of ‘The Automatic Millionaire, a powerful and simple plan to live and finish rich’ by David Bach does, where a couple intelligently manages the Ksh. 5.5 Million a year that they earn and can send their children to the college and buy a second home break, are free of debt and retire with a million dollars in the bank.

This book guides people with financial problems, there are others that encourage readers to have a savings culture for any event that arises

Check Below

1.Unshakeable

2.Secretes of six figure women

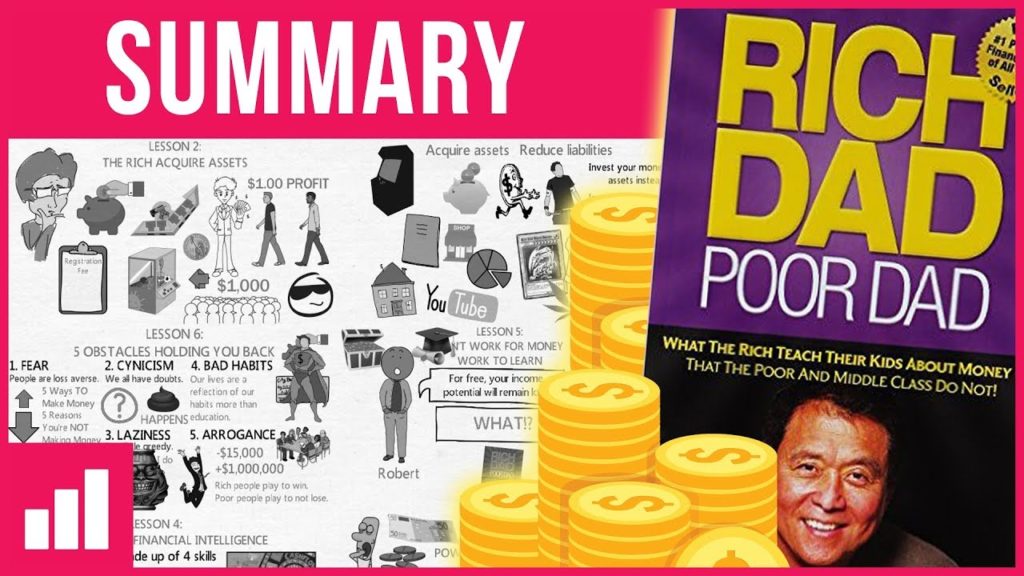

3.Rich Dad Poor Dad

4.Broke Millennial

5.You are a badass at making money

6.The financial diet

7.Love your life not theirs

8.The total money makeover

9.Think and grow rich

10.The 9 steps to financial freedom