As hard economic times bites, every Kenyan is suffering, and even the rich are not excepted.

Large sums of accrued loans are driving our rich and flamboyant celebrities towards between a hard rock and a mountain

Unfortunately, most lenders who are banks have already flagged in and auctioned their deluxe and expensive houses, while others are still looking for their suitable buyers so as they can settle their loans.

Here are some of the celebrities who have been hit hard by poor economy

1.Jeff Koinange – NCBA Bank seeking to recover their 200M loan

Jeff Mwaura Koinange’s city properties are facing a dire headache after they were placed for auctioning over accrued payments

An advert has already been placed in the local dailies to attract those with interest to buy off the two expensive properties belonging to Citizen TV anchor and Hot 96 Radio Host Jeff Koinange.

The NCBA bank is seeking to recover about 130M from the villas that sit on 0.67 acres of land

Interested buyers have been asked to produce a bidding deposit of sh.5 million

“All that parcel land known as L. R. NO. 7741/263 (I. R. NO. 115833) off Kitisuru Road area Nairobi County registered in the name of Jeff Mwaura Koinange,” part of the ad read.

The properties feature a o.2661 ha with two identical four bedroom (all ensuite) villas, each with a detached domestic staff quarter.

The auction has been set on April 28, 2020 on Jeff’s homes valued at 200M

Jeff was said to have been living inside and renting part of the other premises

2.Raphael Tuju – 1.5Bn owed to EABD Bank

Jubilee Secretary Raphael Tuju is currently battling with his health after a heinous accident on his way to late President Daniel Moi’s burial.

Nonetheless, he is also battling a silent war with auctioneers who are seeking to sell off his deluxe property located in Ngong Town, Nairobi.

East African Development Bank (EADB) are accusing Dari which operates the property to have defaulted loan repayment.

Dari is a firm owned by the Jubilee member Raphael Tuju.

The loans were targeted for the construction of Sh100 million two storey, flat-roofed bungalows sitting on a 20-acre forested land dubbed Entim Sidai and purchase of a 94-year-old bungalow built by a Scottish missionary, Dr Albert Patterson, which currently operates as a high-end restaurant.

His loan has fallen behind schedule setting stage for defaults and asset seizures

3.Purish Shah – 240M to Bank Of India

We Hotel and Suites aka Westend Hotel is majorly owned by media businessman Purish Shah based in Nairobi’s suburb area, Westlands.

The Bank of India was owed to Mr. Shah, vice chairman of Radio Africa linked urban station East FM, about 240 million that was defaulted leading to his property being put up for sale

The 7 storey premises if made up of 42 rooms, 14 serviced apartments, spa, gym, conference space and a restaurant on the 7th floor.

Its basement comprises 17 parking spaces and a security office. Its ground floor has a conference centre, laundry area, staff dining room, and stores.

Located on Stima Road off Lower Kabete in Westlands it sits on approximately 0.0858ha (0.212 acres).

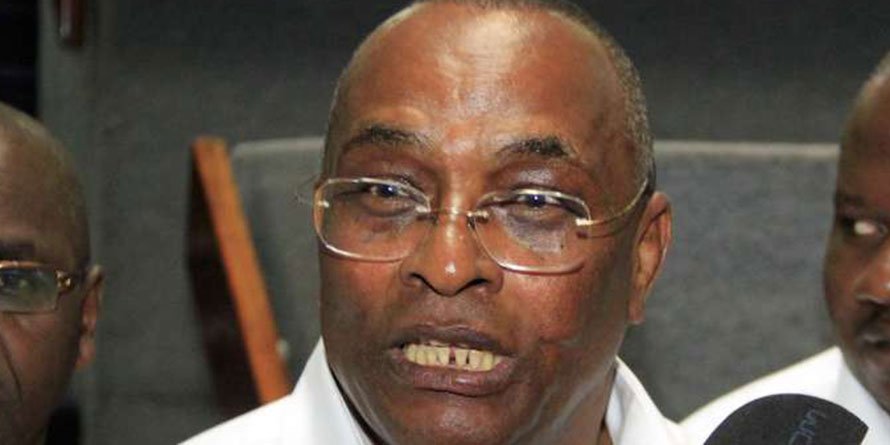

4.Stephen Tarus – 70M

NIC Bank in Nairobi was demanding 70M from the Former Internal Security assistant minister Stephen Tarus .

His double-storey home sits on a 0.4708-hectare parcel of land in the upmarket Karen suburb and has more than five bedrooms.

Business daily accounts that Mr Tarus served as an assistant minister during President Mwai Kibaki’s administration. He also served as Kenya’s High Commissioner to Australia between 2009 and 2012 after losing his bid to be re-elected as MP for Emgwen in 2007.

He had served as the Member of Parliament for Emgwen Constituency between 2003 and 2007.

5.Karume Family -283m

The family of former minister Njenga Karume could not stop the auctioneers who were selling their property Jaracanda Hotel to settle the 283M bank loan

The money was owned to Guaranty Trust Bank.

The hotel is one of the few left business of the late minister. The four star hotel is based in Westland, featuring has 128 bedrooms and sits on 3.5 acres of prime land

6.Suleiman Rashid Shakombo -17M , KCB

His house was sold for 17 million to pay for the KCB loan.

The ex Likoni MP was evicted from the house in 2016 with a court order.

His house was based along Argwings Kodhek Grove in Nairobi.

He also served as the National Heritage minister

7.Gideon Ndambuki – 80m, Housing Finance

The Former Cabinet minister Gideon Ndambuki in Moi’s government defaulted the loan and Housing Fiance sought to recover it.

Mr Ndambuki served as Planning and National Development minister during President Daniel arap Moi’s administration. He unsuccessfully vied for the Makueni gubernatorial seat and was later appointed chairman of the National Social Security Fund (NSSF) in 2017.

8.SK Macharia – 453M , Export-Import Bank of America

SK Macharia who owns Royal Media services was the only lukcy among the rest after he escaped paying about 453M loan to Export-Import Bank of America

The high court tules in favor of Samuel Kamau (SK) Macharia stating that the lender was time-barred in bringing the suit before judges in October 2010 instead of May 2006 in line with the law that demand such cases be heard within six years.

Story source – Business Daily