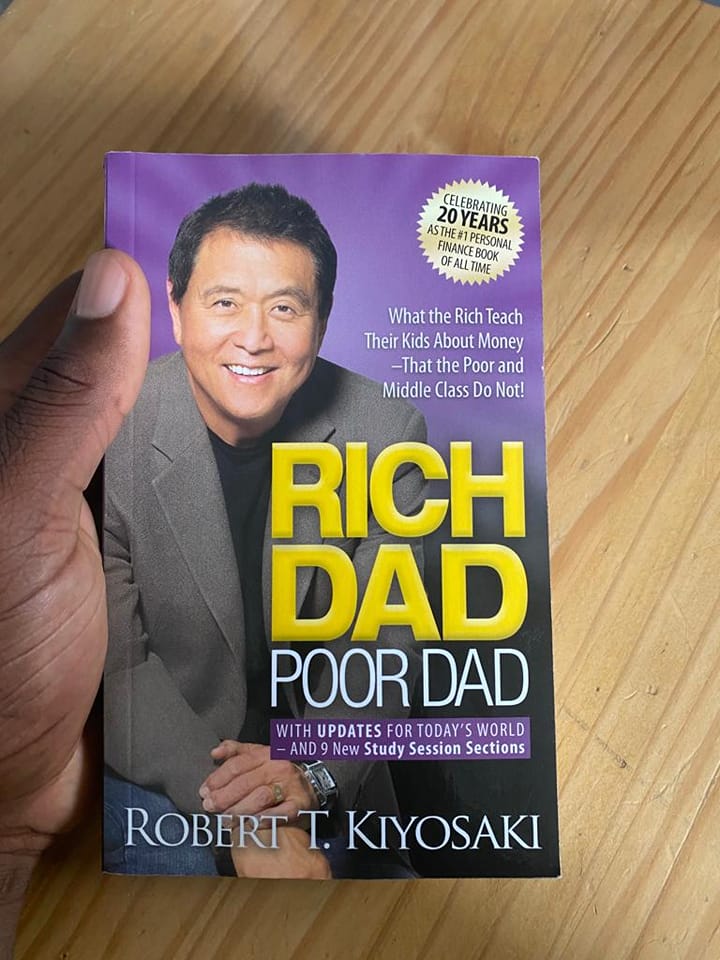

In the pursuit of financial independence and wealth creation, few books have had as profound an impact as “Rich Dad Poor Dad” by Robert Kiyosaki.

With its insightful anecdotes and practical wisdom, this bestselling personal finance classic has transformed the mindset of countless readers worldwide. Here are seven critical lessons from the book that can help pave the path to financial success:

- The Power of the Mind: Kiyosaki emphasizes that our greatest asset is our mind. When trained and cultivated effectively, it becomes a powerful tool for creating wealth and abundance.

- Acquiring Assets vs. Liabilities: Rich individuals focus on acquiring assets that generate income, while the poor and middle class often mistake liabilities for assets. Distinguishing between the two is vital for building long-term wealth.

- The Paradox of Money: Many claim not to be interested in money, yet they dedicate most of their waking hours to earning it. Recognizing the importance of financial education and actively working towards financial literacy is crucial.

- The Rich’s Financial Philosophy: The rich prioritize investing their money and allocate their expenses accordingly. In contrast, the poor tend to spend first and invest whatever is left, hindering their path to financial freedom.

- Embracing Failure: Failure is an integral part of the learning process. Kiyosaki highlights the value of embracing failure and learning from setbacks, as they provide invaluable insights into personal growth and eventual success.

- Emotional Neutrality: Successful business owners and investors maintain emotional neutrality towards both winning and losing. Understanding that wins and losses are natural components of the game fosters resilience and a more strategic approach to financial endeavors.

- Work for Knowledge, Not Money: Breaking the addiction to money is vital for personal and financial growth. Instead of solely working for monetary gain, Kiyosaki encourages individuals to work with the intention of acquiring knowledge, as it paves the way for greater opportunities and success.

“Rich Dad Poor Dad” serves as a financial wake-up call, challenging conventional beliefs and inspiring readers to take control of their financial destinies.

By internalizing these seven critical lessons, individuals can transform their relationship with money, cultivate a wealth-building mindset, and embark on a path towards financial freedom.

Remember, true wealth is not solely measured by the size of one’s bank account, but by the knowledge and financial intelligence accumulated along the journey.